If we look in depth, and this is an in depth look, at how and why Lord Nimmo Smith arrived at his decisions when he was asked to, er, investigate the shennanigans at Ibrox and the SFA, we see one or two new pieces of evidence that should , in fact, mean that his decisions are now no longer relevant.

In fact, it is now important that a proper inquiry, with perhaps an independent chairman, looks at all the facts and all the evidence.

This is a long read, and some of the information within is quite complex, and perhaps requires even further explanation.

What I would like to ask the reader, if I may, is to ask questions in the comments section.

Even if you think the question is basic, please ask it anyway. There is a danger that it may seem over complicated, and it may not explain the issues as clearly as we hope.

Those questions will be answered in a follow up “Frequently Asked Questions ” type article in order to clarify anything that anyone is unsure of.

Please take the time to read it all the way through, and if you do stop at any point, tell us why…

Reasons Lord Nimmo Smith Treated DOS (WTC) ebts as Continuous with MGMRT (BTC) ebts

Introduction.

With the news that Ex Rangers players and current employees are being pursued by HMRC to recover the tax avoided by their use of ebts and how Lord Nimmo Smith used the “lawfulness” of ebts at the time he was arriving at his decision to justify why no sporting advantage was gained from non disclosure of side letters

“ Nor is it a breach of SPL or SFA Rules for a club to arrange its affairs – within the law

– so as to minimise its tax liabilities. The Tax Tribunal has held (subject to appeal) that Oldco

was acting within the law in setting up and operating the EBT scheme.”

It might be useful now that those ebts were not within the law to look at how Lord Nimmo Smith excluded the DOS EBTS that were unlawful at the time he excluded them from his scrutiny.

The following blog by Auldheid has been has been in suspension for a while as it is lengthy and a bit technical, but I think it is now timely to put it out there to remind us of the rampant non disclosure that one club and one club only has been guilty of and how they have benefitted from their dishonest behaviour by hiding inconvenient truths, with a little help from their So Friendly Associates.

Background

Way back in 2012 before Lord Nimmo Smith, Nicholas Stewart and Charles Flint sat on the then SPL Commission investigating the use of ebts and side letters to pay Rangers FC players’ wages, there were allegations of impartiality because Lord Nimmo Smith had taken part an earlier preliminary investigation in February/March 2012 into Craig Whyte’s tenure at Rangers that led to Craig Whyte being charged with bringing the game into disrepute. What took place at that investigation was covered in an earlier E Tims article at https://etims.net/?p=13042 .

That blog covered the period 6th December 2012 to 23 April 2012 and leaves lots of unanswered questions.

However in a response made on 12th September 2012 to allegations of impartiality, the three judges involved produced “ Reasons” why the Commission was correct to proceed and lo and behold it explains the basis on which the DOS EBTS were omitted from the Nimmo Smith Commission.

The “Reasons” document was published in full by the SPL at

https://spfl.co.uk/news/article/commission-reasons-for-september-12-decision-2012-09-20/mediaassets/doc/SPL%20Commission%20reasons%20for%20decision%20of%2012%20September%202012.pdf and at 21 pages it is a long read.

Another copy of the full Reasons document can be viewed at

https://drive.google.com/file/d/18OKUVuFq2RuBFxgIZ493Dc1xry4aPZfj/view?usp=sharing

but with added comments in red, including extracts from the testimony Andrew Dickson provided to the FTT in April 2011, which demonstrates that he, like Campbell Ogilvie knew the difference between the DOS EBTS used to pay De Boer and Flo from 2000 to 2002 under the unlawfully used Rangers Employee Benefit Trust (REBT) and the ebts paid to him and Ogilvie and numerous Rangers players via the Murray Group Management Remuneration Trust (MGMRT), but. like Campbell Ogilvie made no clarification in his testimony to LNS.

Are Dickson and Ogilvie amongst the current and ex employees HMRC are now pursuing for unpaid tax?

Here now are the reasons the DOS EBTs were not considered by the LNS Commission taken from The Reasons document with added comments in red :

[14] The topic of the employee benefit trust (“EBT”) referred to in the Issues before this Commission was touched upon in two paragraphs (and only those two) of the report of the Special Committee of the SFA, (produced in February/March 2012 but never made public) but no recommendation was made to the Board in that regard. The main reasons for not making a recommendation were:

(1) the EBT came into existence several years before the period with which the Special Committee was concerned; This will be the DOS ebts which did precede Craig Whyte taking over RFC but in the Takeover Agreement he undertook to pay the liability that was discovered as a result of due diligence by Wavetower in March 2011. The failure to pay it by CW was deserving of inclusion in the Judicial Panel that charged him with bringing the game into disrepute as were the charges relating to non payment of PAYE and VAT, but for some reason it wasn’t.

and (2) there was in any event no sufficiently clear evidence of a breach of SFA Article 12.3 to justify any further action at that stage.

Au contraire – there was ample evidence in the form of HMRC letters to RFC from November 2010 to 20th May 2011 to justify a breach of Article 12.3 which says

“12.3 All payments, benefits or consideration of any description which are to be made to a player by or on behalf of a club in respect of or in connection with that player’s playing or training activities for the said club (other than re-imbursement of expenses actually incurred) must be fully recorded within a written agreement between the club and the player which must be submitted to the Scottish FA.”

Given that the payments to De Boer (and Flo) under the DOS ebt with side letters were clearly detailed along with the justification HMRC had for collection under Extended Limits (over 6 years) , which was RFC had denied the existence of those side letters to HMRC, then why was there no sufficiently clear evidence unless it was deliberately not provided to SPL lawyers by RFC Administrators Paul Clark and David Whitehouse as part of the SPL investigation beginning 5th March 2012, months before LNS provided his reasons?

All the more questionable since Clark and Whitehouse) had clear knowledge of the details based on their Points of Claim against Collyer Bristow in that same month in 2012.

In fact the non disclosure by Paul Clark and David Whitehouse was more than a failure to provide documentation, it was non disclosure of information that they had full knowledge of based on their Points of Claim of March 2012 that contained this information:

“ The Tax Liability

7. Between 1999 and 2003 the Club entered into an arrangement with some of its players providing that their salaries would be paid through a purportedly discretionary scheme thereby seeking to avoid liability for PAYE and NIC. There were two schemes in operation, the DOS and an Employee Benefits Trust Scheme.

8. The DOS was utilised by two players Mr Ronald de Boer and Mr Tore Andre Flo. The discretionary nature of this scheme was illusory. The Club provided side letters to the players dated 30 August 2000 and 23 November 2000 respectively identifying precisely when and how much would be paid through the Scheme. The payments to these players were not discretionary and payments were accordingly liable for PAYE and NIC (the “Tax Liability”).

9. On 18 February 2011 Mr XX of HMRC received a telephone call from Mike McGill the Finance Director of Murray International Holdings Limited. During this conversation Mike McGill stated that he had taken leading counsel’s advice and the Club accepted the Tax Liability. At a meeting on 21 March 2011 Mike McGill provided XX of HMRC with a computation of the Tax Liability in the sum of £2,827,801 including interest.

10. In the Club’s Interim Report for the six months to December 2010 the Club made a provision for the Tax Liability in the sum of £2,770,000.

11. On 20 May 2011 HMRC raised assessments for the principal due in respect of the Tax Liability in the sum of £1,998,995. HMRC was also entitled to interest. The Club had 30 days to appeal under section 49(3) of the Taxes Management Act 1970 and thus the time for appealing the assessments expired on 20 June 2011.

12. On 16 August 2011 HMRC raised penalty determinations.

13. On 28 September 2011 the Club appealed the Tax Liability out of time. On 20 February 2012 the Administrators withdrew that application.”

Why Clark and Whitehouse did not disclose these details or the HMRC letters providing them to the SPL lawyers is not known, but the evidence of dishonesty as in accusations of deliberate behaviour negligent or fraudulent in the HMRC letter of 20th May 2011 and a previous even more detailed one of 23 Feb 2011, had it become public would have made it more difficult to sell the remains of RFC with any guarantee of SFA membership.

Non disclosure however began in 2011 under UEFA FFP 2010. Rangers had a duty to report significant change to the SFA and UEFA specified what significant change is.

Significant change

An event that is considered material to the documentation previously submitted to the licensor and that would require a different presentation if it occurred prior to submission of the documentation.

And refer to it under

Article 13 General Responsibilities of Licence Applicant para 3

Article 43 1d Declaration signed by applicant clubs.

Article 56 c) to “ promptly notify the licensor in writing about any subsequent events that constitute a significant change to the information previously submitted to the licensor.

Thus in 20th May 2011 RFC were required to provide the very evidence whose absence led not only to CW not being charged with meeting his undertaking to pay the DOS ebt liability but its continued non-disclosure during the rest of 2011, right up to the start of the SPL investigation in March 2012, prevented both the SFA JP against Craig Whyte and LNS Commission against RFC being conducted under the more relevant charges of the June 2018 JPDT against RFC i.e. for non compliance of SFA Articles relating to loyalty and good faith to other SFA members. Lesser charges of mis registration were made instead resulting in lesser sanctions than if dishonesty had been the charge.

This non disclosure allowed Lord Nimmo Smith to treat DOS ebts under the Ranger Employee Benefit Trust (REBT) and the Murray Group Management Remuneration Trust (MGMRT) ebts as continuous and so lawful, apparently unware of the significant difference in the unlawful use of the DOS ebt at the time of the Commission, as opposed to the then lawful use of MGMRT ebts.

LNS was not aided by either of the two testimonies by Campbell Ogilvie who instigated the DOS ebts on 1999 and was a recipient of the MGMRT ebt and Andrew Dickson’s another MMGRT recipient who gave written testimony to LNS that did not mention his knowledge of the De Boer ebts as revealed in his testimony to the FTT on the use of the MGMRT ebts. He admitted to the FTT under questioning to having to convince Ronald De Boer and his agent that De Boer should move from the DOS arrangement to the MGMRT one.

Now that the present Notice of Commission has been prepared, it can be seen that there is no overlap between the period with which the Special Committee was concerned and either the period to which the first three chapters of the Issues relate or the subsequent period to which the fourth chapter relates.

Para 17 that follows from The Reasons document sums up para 14

[17] Bearing this test in mind, the Chairman, in consultation with the other two members of the Commission, has given careful consideration to this question, and has concluded that the fair-minded and informed observer, having considered the facts, and in particular the terms of the SFA Special Committee report quoted above, would not conclude that there was a real possibility that the Chairman was biased. The main reasons are, as already indicated, that:

(1) those of the present Issues which relate to the EBT arise from a period which ended before the period with which the SFA Special Committee was concerned;

Only if you exclude the undertaking by CW to pay the liability from the earlier period during his period of tenure

and

(2) not only did the SFA Special Committee not reach any conclusion about the EBT, it did so because there was insufficient material to enable it to reach any conclusion.

Only because of non-disclosure by RFC in May 2011 of 20th May HMRC letter which said

In respect of Flo:

“ I have decided to make the assessments as it is my view that the amounts reflected in the assessments arise due to the deliberate behaviour or fraudulent behaviour of the company.(MIH who denied existence of side letters in 2005 to HMRC)

And in respect of De Boer.

“ The arguments about deliberate or fraudulent behaviour in the case of Flo apply equally to De Boer. The side letters provide the entitlement and the employer was aware that the payments ought to have been made under PAYE. It would appear that no professional guidance was taken on the position including the side agreements that gave rise to the payments.”

Which was followed by more non-disclosure by Clark and Whitehouse in 2012, made worse by the lack of candour on the part of Campbell Ogilvie and Andrew Dickson in their verbal and written testimony to LNS.

The questions arising are:

Had all the information in the possession of Rangers FC in 2011 and 2012 and the SFA in terms of Campbell Ogilvie’s and Andrew Dickson’s (as a Licence Committee Member) awareness of the two types of ebts and assuming the SFA had no record or knowledge whatsoever of the contents of the 20th May 2011 HMRC letter from May 2011 to February/March 2012 , would the reason for the Decision of 12 September 2012 to exclude the DOS ebts from scrutiny by the Commission still stand had the information been supplied?

(Remember Regan spoke to Dickson about the wee tax case and UEFA Licence on 6th December 2011 two months before Regan and LNS met in February in 2012 to discuss the charges against Craig Whyte.)

The Judicial Panel Disciplinary Tribunal on UEFA Licence 2011 should give some indication of the full extent of any failure to meet any of the 3 UEFA FFP articles on significant change provided earlier, which should require the above question to be posed to those on the JPDT who should be considering if RFC were in breach of UEFA FFP at end of May 2011.

Events at the end of March 2011 are apparently excluded from JPDT for as yet unknown reasons at odds with presented evidence for inclusion, but if all of the foregoing forms the Terms of Reference for referral to CAS as the 5 Way agreement appears to require, then the whole house of cards will fall.

The Terms of Reference should cover all aspects of the case, not cover up some.

Rotten to the core. How the hell they get away with this is beyond the pale.

Where are the clubs in all this? They are deliberately turning a blind eye to all this. They are involved in the cover up.

Excellent investigation and post. Small point, please alter dates under ‘Background’ ‘That blog covered the period 6th December 2012 to 23 April 2012…’ Doesn’t seem right.

As I understand it the outcome of the LNS inquiry returned the perfect result for Rangers in that they were found guilty, albeit of a process flaw (their approach to registering players) rather than breaking any rules. The perfection of that outcome is that they can say LNS found us guilty and we were fined accordingly, although I’m not sure if the fine has ever been paid, maybe I’m wrong.

My question is this, based on the LNS judgment or ruling what legal avenues exist to challenge the ‘guilty’ verdict here?

It’s been a while since I’ve looked into this so please accept my apologies if my understanding is incorrect.

The Sfa paid the fine to themselves by witholding TV money from

sevco

SFA are rotten to the core. The terms were rigged from the start – it’s no coincidence the result fit with what they could do under the five way agreement. Does anyone really think the SFA would have allowed an enquiry that would put them on the spot? Time for the SFA to be made answerable to fans, clubs and players alike. https://www.change.org/p/scottish-football-association-fundamental-change-at-the-sfa

Should have a crowd funding to challenge this, just look at what alex Hammond doing to Scottish government. Justice for all clubs who were robbed by these injustices,

Crowd Funding may be required to pay for an effort by the Res 12 lawyer, but if it is, it will be worth the price.

It is well past the time where we should have had a statement of intent from Celtic Football Club PLC.

This was fraud on an indusrial scale, every football club in Scotland was at a disadvantaage but what the Celtic PLC should be chasing down is the massive amount of cash stolen by Murray from Celtic shareholders. That’s what a PLC is for, making money for their shareholders (us in the main).

We get hugely frustrated when we, as fans, see the seemingly parsimonious board baulk at handing out OUR money in the transfer market.

Yet the same board are, it would seem. quite happy for Murray/Masterton/Ogilvie/Longmuir/Bryson/Smith, the list is long, cheat their way to skim multi-millions from our PLC by brown enveloping superstars.

Sadly, I suspect, there was some collusion in the Hun remaining as some sort of entity post liquidation which they want brushed under the carpet. I really hope I am wrong but the clubs silence on this issue, which is THE biggest untold scandal in brittish sport (hang your head in shame SMSM and government) is pretty damning.

There is a bit more to come focussing on the Judicial Panel Protocol that Aberdeen and the CSA have raised doubts about, heck even smsm are asking questions.

At last the issue of trust in the governance of Scottish football has been aired by a club other than Celtic and if Celtic don’t jump on that bandwagon (if they aren’t pushing it anyway) then the game is a bogey.

WHY has this not been dragged out into the open? Even Roy Greenslade coughs and splutters when he’s quizzed about the Offshore Tax Game. Darryl Broadfoot (the ex-Director of mis-information at the SFA) is also up to his nuts in guts over this, he, of the, “I AM THE SFA” infamy goes all coy when questioned over anyting to do with Res 12, Offshore Tax Game etc.

Something completely unrelated might get them squealing, I imagine a class action attack by ex-players when HMRC gets heavy might breech the dam. The players were of course assured that the CLUB would indemnify them if made to cough up, and we all know Rangers ARE the same CLUB.

LNS was duped by half truths and incomplete information. He himself ought to call for an independent review of his findings based on new evidence which has since surfaced and the full story which has dropped out over time. For his own integrity and the rule of law, the verdicts/decisions at LNS need urgent review. I’m unsure how that can be done using due legal process and I’m pretty sure that it can be if LNS himself admits that he was given less than half of the facts and the story. LNS over to you.

Interestingly in the correspondence released last September between the SFA and Celtic one suggestion from Regan to Celtic/SPFL is that they take SDM’s testimony to LNS and ask if it would change anything.

Now if they added everything that has been exposed in 2011/2012 to that suggestion there would have to be a different decision.

The thing is neither the SPFL nor Celtic have acted on Regan’s suggestion.

That leads to two thoughts.

Regan knew the SPFL knew and

SpFL know Regan knows what took place, so no chance of it happening.

It’s all about protecting each other and screwing suppprters as they have been for years.

It’s been long established that SFA are not fit for purpose, we the fans should be pushing for a plubic inquiry and those that tried to pervent justice been done charge with perverting the course of justice. Also banned from any connection to do with football. It’s time to cut out this cancer from our game .

I am a great one for facts , funny how a week back in Ireland brings the old form of phrasing back, and facts are in abundance here. Thecwhilecedesrchjbg from Phil’s original to the case toon 12 analysis is impressive by any standards . I believe someday it will all be revisited and just like other things the truth will out. Recently archives in Belfast identified advice from an early Chief Constable to the Stormabt Government warning them that their attitude to the Civil Rights movement would back fire, it would create civil disorder and eventually encourage the emergence of a more modern IRA with real support in the nationalist community, all that in 1968! The Unionists did it, all their own work snd theirvown people

warned than, you couldn’t make it up. Today the DUP oncec the purest of the pure ( or so they thought) are wrapped in corruption over RHI, holidays paid for by foreign governments etc, it is a divided house and we know what will happen, here’s to “ Ten in a Row.”

There is a possible answer that might explain although some who think PL blows fireballs out his arse might not like it.

Stay tuned to Social Media.

As you know I like facts and evidence as opposed to monosyllabic abuse. This scrutiny like Phil’s original work and the Section 12 research has the merit of being thorough and convincing. I believe some day the truth has to come out and it will, with all this work being a foundation. Yesterday’s N I television news revealed in the archives warnings from the RUC Chief Constable that the Stormont Government’s violent response to the Civil Rights marches in 1968 would lead to civil disorder, escalation of violence, the creation of an IRA with widespread support in the nationalist community, none of which were there in 1968 or before. The Unionist politicians thought they knew better, snd the written warnings from their own man was hidden for 50 years.. The DUP has always adopted a” holier that thou” attitude but now emersed in corruption from Ian Paisley jnr to Arlene Foster. It all comes out and us, well we are on our way to “ Ten in a Row.”

Stewart Regan invited LNS to chair the enquiry into “Rangers, Stewart Regan “set the parameter’s” into the enquiry. The enquiry panel also consisted of Niall Lothian, past president of the Institute of Chartered Accountants, Mr. Bob Downes, the deputy Chairman of SEPA. and of course Mr. conflicted, Stewart Regan, his slippery paw prints are all over this enquiry. It was said that “Rangers” were given NO title stripping guarantees, but is that true? Or was it not part of Scottish footballs dirty secret, the 5way agreement? In fact Charlotte Fakes said it was, when she/he described a part of the 5way agreement’s final draft, so far nobody has contradicted her.

Was LNS and his two esteemed colleagues duped? or were they the Lee Harvey Oswald’s of Scottish football? Mr. Patsy’s.

Scottish football under Regan and Doncaster were a part of the secret cabal which included RRM, President Ogilvy, the top man for player registrations Sandy Bryson and the mister man, Andrew Dickson and Darryl Broadfoot. Did they scupper any chance of title stripping? Charlotte Fakes revealed part of the final draft of the 5way agreement between, oldco, newco, SfA, SPL and the SFL. which promised immunity to “Rangers” from any disciplinary action on EBTs. Were they so frightened of Armageddon that the “Rangers” demise threatened? that they would turn a blind eye to everything? Clearly the LNS enquiry is compromised and must be revisited “Rangers” must be stripped of the five titles that they won by cheating. No paltry fine for them, knowing that, that fine would never be paid.

“It enabled the club to attract players who would not otherwise have been affordable”…. “To gain a sporting advantage”

Yours from court, Mr. Black.

This current blog is just part of the picture, and to put that picture in a frame TSFM have been digging. The whole JPP as established is merely a device to keep the SFA in control.

https://www.sfm.scot/jpp-perverting-justice/

The Sfa paid the fine to themselves by witholding TV money from

sevco, all part of the great conspiracy

Why have CELTIC FC not made a statement about the sfa bowing down to King on the charges they were meant to face from the sfa when sevco told them they have no jurisdiction over them come on CELTIC you owe it to everyone who attends Celtic park for every home game and buying the clubs merchandise HH

FUCK THE SFA!

Okay, since you ask nicely:

https://youtu.be/aeIVXJ5HCL0

Cheers Cha!

With regards to the Police, for some of us middle aged guys let me educate you…..there are a number of Police who fucking hate you, it’s that simple.

I have faced it myself on more than one occasion, some, not all fucking hate Celtic & our support….if you get that you’ll get them.

This is Scotland!

Did i bow down to them?

They would say eventually 🙂

“Impartiality” is the very quality one ought to expect of any arbiter or judge. So “allegations of impartiality” are like something that Huns would make.

Resistance beats Persistance…….Signed All the park the bus teams in Scotchland…..

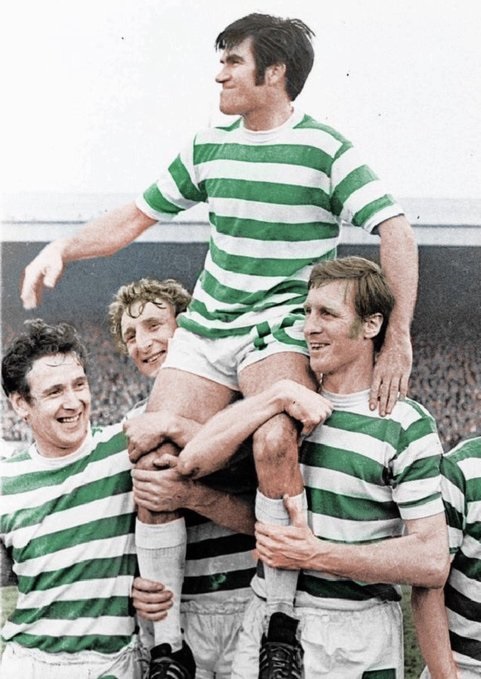

Congratulations to Celtic last night for not being defeated despite playing so long with only 10 men.Brown and JF were particularly good.Could I just remind folk that I stated Shagger Leigh would be at Parkhead after BR has departed? Congratulations Leigh,I know,from actually talking to you,how committed you are to the Tim-A-Loy……Going for 150….

Cores, “impartiality” is a quality one ought to expect from a judge but I have serious misgivings in this case. I have always thought that LNS enquiry should have left an opening for the enquiry to be re-convened should the situation change regarding the legality of the EBT case which was still in dispute at the time of LNS findings. Given that he based his findings on the supposed legality of the scheme surely, in the interests of a full and fair decision based on all relevant facts, he should have left a proviso that he would be prepared to re-visit the case if there was a material change in the facts which had been put before him?